hawaii capital gains tax exemptions

Those who earn 60000 or more are subject to a 7 capital gains tax rate in Hawaii. The Hawaii capital gains tax on real estate is 725.

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

13 Corporate income tax.

. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. 112 Capital gains tax.

Hawaii taxes both short- and long-term capital gains at a rate of 725. A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to 500000 if they 1 owned the home for. Ad Track Clients Potential Tax Liability with Tax Evaluator.

You will be able to add more details like itemized deductions tax credits capital. Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Contact a Fidelity Advisor.

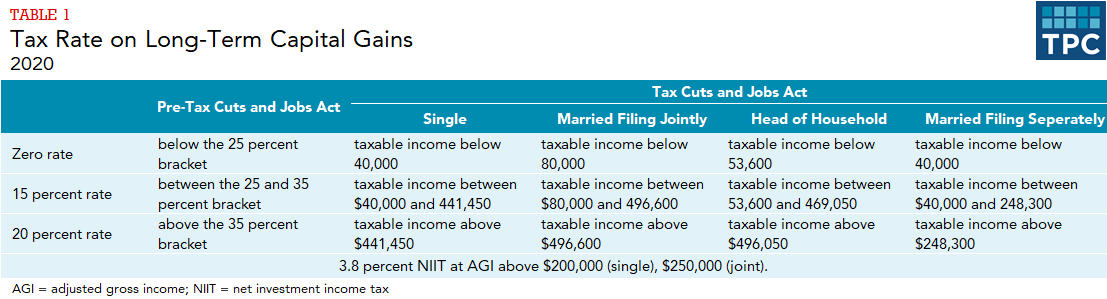

Hawaii taxes capital gains at a maximum rate of 725In order to insure collection of this tax and any other taxes you owe may owe the state. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. A short-term rate same as your income tax rate and b long-term rate for respective 2018 income brackets.

The Hawaii capital gains tax on real estate is 725. This applies to all four factors of gain refer below for a discussion of the four factors. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains.

2016REV 2016 To be filed with Form N-35 Name Federal Employer. Capital gains are currently taxed at a rate of 725. Generally only estates worth more than 5490000 must file an.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Form N-289 Certification for Exemption from the Withholding of Tax on the. Gains from the transfer of land buildings or machinery from an urban area to a Special Economic Zone are exempt from taxation if the profit is reinvested to buy.

The difference between how much is withheld and. Some absentee owners are exempt from the HARPTA law. However the fact that an owner may be exempt from the HARPTA law does not also exempt the owner from paying state capital.

Before you start to get anxious there are waivers that. The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states. However in March of 2021 a bill passed through the Senate that would raise capital gains tax rates to 11.

15 Estate and inheritance taxes. Contact a Fidelity Advisor. You probably wont take a big capital gains tax hit if you sell your primary residence.

Hawaii residents and nonresidents alike must pay Hawaii income tax on capital gains recognized on the. Single taxpayers can exclude up to 250000 in capital gains on the sale of their primary. HARPTA Hawaii Real Property Tax Act withholds 725 from any Non-Hawaii Resident or Entity who are selling with capital gains.

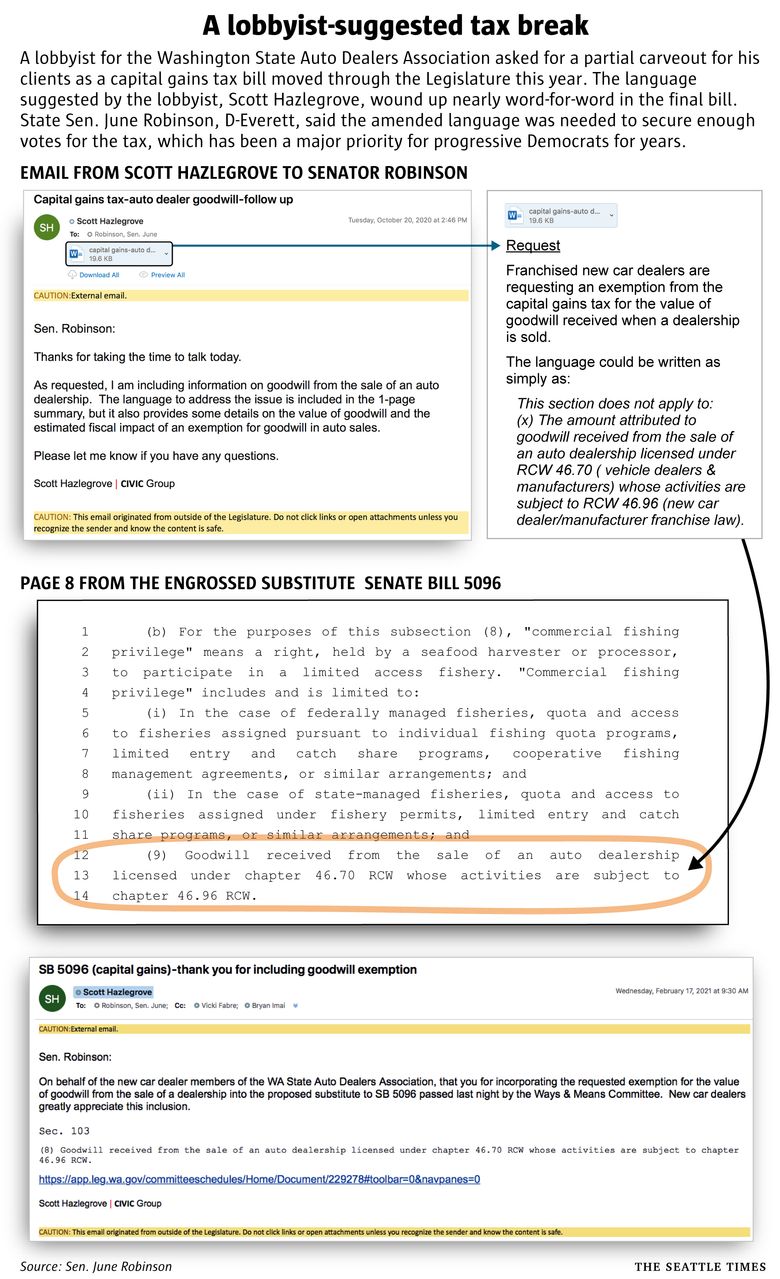

How Auto Dealers Lobbyist Wrote An Exemption Into Washington S New Capital Gains Tax Law The Seattle Times

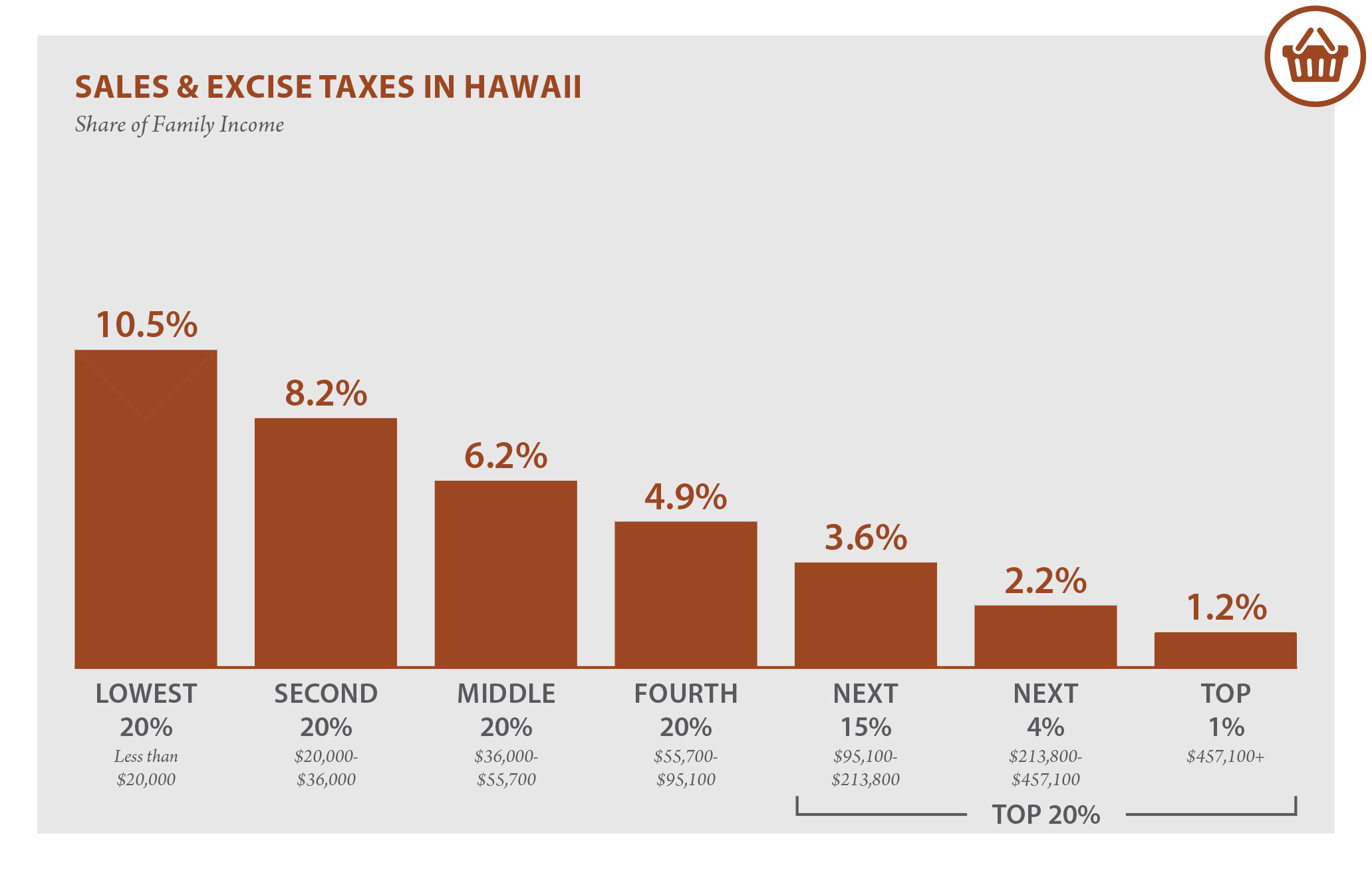

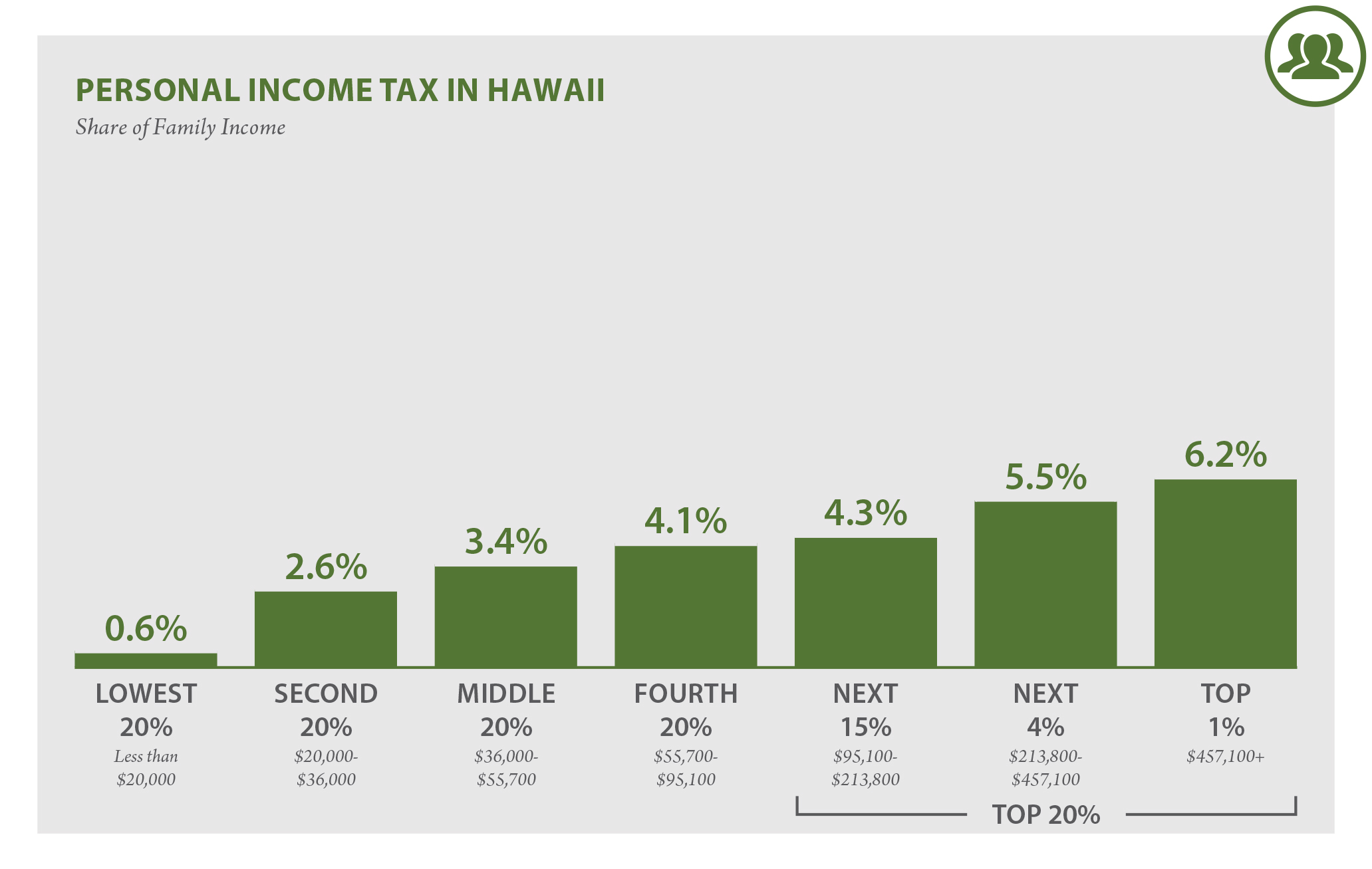

Hawaii Who Pays 6th Edition Itep

Hawaii Income Tax Hi State Tax Calculator Community Tax

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Hawaii Who Pays 6th Edition Itep

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

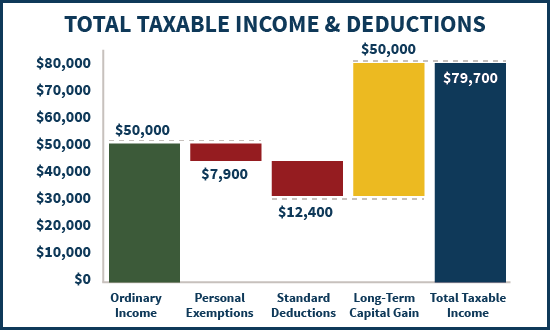

Mechanics Of The 0 Long Term Capital Gains Rate

How Are Capital Gains Taxed Tax Policy Center

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

What Are Capital Gains Tax On Home Sale In Dallas

Hawaii Real Estate Transfer Taxes An In Depth Guide

How Do State And Local Individual Income Taxes Work Tax Policy Center

Capital Gains Taxes Are Going Up

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition